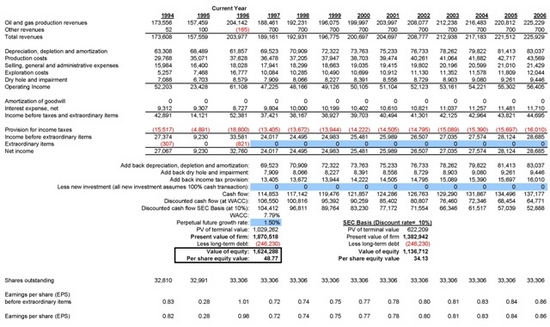

Oil&gas e&p co valuation model for excel

Download URL | Author URL | Software URL | Buy Now ($169.95)

This Microsoft Excel workbook accepts input from publicly available 10-K reports in order to calculate the total and per-share value of an oil and gas e&p company. Model allows the user to input expected oil and gas prices and vary production growth by year and commodity. In addition to general performance measures, E&P industry-specific ratios are also calculated. Includes: Income Statement, Balance Sheet, Weighted-Average Cost of Capital Calculator, Oil Industry-Specific Discounted Cash Flow (DCF) Analysis, Oil Industry-Specific Ratio Analysis. Developed by CFA Charterholder.

Related software (4)

Business Valuation Model for Excel

Microsoft Excel workbook accepts input from publicly available 10-K reports in order to calculate the total and per-share value of a business. Model is flexible and allows the prac ...

Energy Development

heartland energy,energy development corporation,heartland energy development corporation, energy and oil,heartland energy company,colorado oil and gas,colorado energy company,heart ...

Energy Development

heartland energy,energy development corporation,heartland energy development corporation, energy and oil,heartland energy company,colorado oil and gas,colorado energy company,heart ...

Venture Manager

Venture Manager provides joint venture cash calls, joint interest billing and revenue distribution.