Optionmatrix for linux

Download URL | Author URL | Software URL | Buy Now ($0)

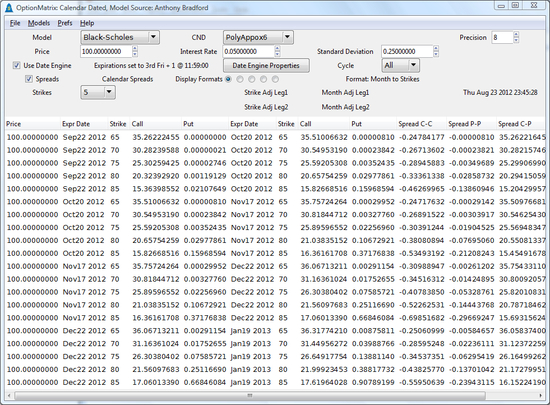

A real-time generalized financial derivatives calculator supporting over 136+ theoretical models from open source libraries. Matrices of prices are created with iterating strikes and/or months. A strike control system can produce any strike. A generalized date engine can calculate re-occuring distances to any industry used expiration into the future. Spread engine with spread views. Timing is accurate to one second and pricing is re-calculated every second. 9 choices for computing the cumulative normal distribution. All inputs can be changed on the fly with spin buttons, comboboxes, scale buttons and calendar selection.

Models Supported: Black-Scholes, Merton-73, Black-76, Roll Geske Whaley, Garman KohlHagen, Jump Diffusion, Quanto, Vasicek Bond Option, Turnbull Wakeman Asian, TimeSwitchOption, Look Barrier, PartialTimeBarrier, GapOption, Extreme Spread Option, Simple Chooser, ComplexChooser, PartialFixedLB, Executive, CashOrNothing, Extendible Writer, OptionsOnOptions, BAWAmericanApp

Related software (5)

TaxMe-UK

TaxMe-UK provides a break-down of the tax and other deductions on your UK salary. Just configure your personal details, and those of your partner, to see how much income tax, nat ...

LSL Financial Suite

Financial Suite contains 4 financial applications, from Lakshmi Solutions LLC, giving the user many options for performing financial calculations: 1) Cash Flows 2) Investment Optio ...

Financial Calculator

This program shows large numbers without showing them in exponential form. This program could translate into any language. This program has two official languages (English and Pers ...

OptionMatrix for Mac OS X

A real-time generalized financial derivatives calculator supporting 136+ theoretical models from open source libraries. This is not a 1 line options calculator but rather a option ...

OptionMatrix

A real-time generalized financial derivatives calculator supporting 136+ theoretical models from open source libraries. This is not a 1 line options calculator but rather a option ...