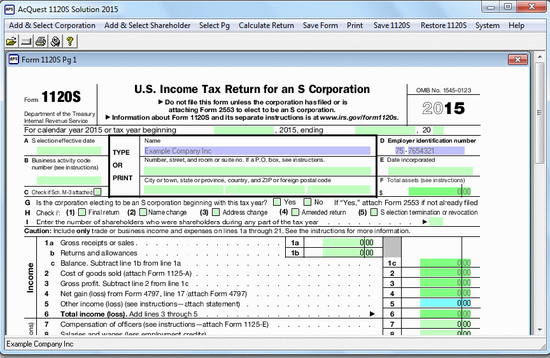

Acquest 1120s solution 2015

Download URL | Author URL | Software URL | Buy Now ($28)

AcQuest 1120S Solution 2014 is designed to run on Windows XP, Vista, & Windows 7 & 8. It will prepare the five pages of federal Form 1120S, U.S. Corporation Income Tax Return for an S Corporation, Schedule K-1's, Schedule D, Form 4562, Form 4797, Form 7004, Form 6252, Form 8825, Form 8949, & Depreciation Schedules, with the unregistered version limitation that data can be printed but not saved. The program includes a built in depreciation calculator that transfers depreciation to Form 4562. Data from prior years programs can be imported to reduce data entry time. Program license keys can be purchased for single return preparation or multiple return preparation.

Related software (5)

Tax Brackets Calculator 2005

Tax Brackets Calculator displays tax brackets for federal income tax years 2000-2005, calculates you federal tax given your taxable income and estimates average tax rate.

Basic Bookkeeping

Unlike double entry systems, Basic Bookkeeping's single entry method is intuitive. You simply enter your income and expenses. The program then generates a wide variety of reports f ...

AcQuest 1120 Solution 2015

AcQuest 1120 Solution 2014. Windows XP, Vista, & Windows 7 & 8. Prepares federal Form 1120, U.S. Corporation Income Tax Return, Sch D, 4562, 4797, 7004, & Deprn Schs. With unregist ...

AcQuest 1065 Solution 2015

AcQuest 1065 Solution 2015. Windows XP, Vista, & Windows 7 & 8. Prepares federal Form 1065, U.S. Return of Partnership Income, K-1's, Sch D, 4562, 4797, 7004, 8825, & Deprn Schs. W ...

AcQuest 941 Solution 2015

AcQuest 941 Solution 2015. Windows XP, Vista, & Windows 7 & 8. Prepares federal Form 941, Employer's Quarterly Federal Tax Return. With unregistered version, data can be printed bu ...