Acquest 941 solution 2015

Download URL | Author URL | Software URL | Buy Now ($15)

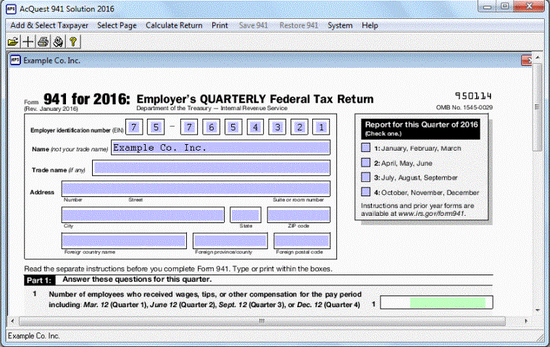

AcQuest Programming Solutions is pleased to publish the 941 Solution 2015. Designed to run on XP, Vista and Windows 7 & 8, the 941 Solution is intended to be used to prepare federal form 941, Employer’s Quarterly Federal Tax Return. Calculates and prints Form 941 for multiple companies. Copy command carries company names, addresses, and EIN’s over from prior quarters to reduce the need to reenter data. Saves input data to disk for later editing. Online help and IRS form instructions. Traditional offline software providing privacy, speed, permanence, and uninterrupted availability. The unregistered (e.g. demo) version allows completed forms to be printed, but data cannot be saved.

Related software (5)

Tax Brackets Calculator 2005

Tax Brackets Calculator displays tax brackets for federal income tax years 2000-2005, calculates you federal tax given your taxable income and estimates average tax rate.

PayWindow Payroll System

Pay by any pay period; hourly, salaried, commissioned, non-employee workers; prints Checks, 941, W2s, 1099-MISC forms and reports galore! Over 30 years of experience make this the ...

AcQuest 1120S Solution 2015

AcQuest 1120S Solution 2014. Windows XP, Vista, & Windows 7 & 8. Prepares Form 1120S, U.S. Corporation Income Tax Return for an S Corporation, K-1's, Sch D, 4562, 4797, 8825, & Dep ...

AcQuest 1120 Solution 2015

AcQuest 1120 Solution 2014. Windows XP, Vista, & Windows 7 & 8. Prepares federal Form 1120, U.S. Corporation Income Tax Return, Sch D, 4562, 4797, 7004, & Deprn Schs. With unregist ...

AcQuest 1065 Solution 2015

AcQuest 1065 Solution 2015. Windows XP, Vista, & Windows 7 & 8. Prepares federal Form 1065, U.S. Return of Partnership Income, K-1's, Sch D, 4562, 4797, 7004, 8825, & Deprn Schs. W ...