Acquest pro depreciation

Download URL | Author URL | Software URL | Buy Now ($125)

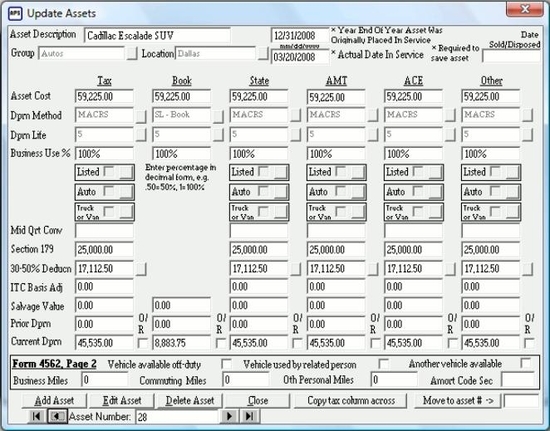

AcQuest Pro Depreciation is designed to run on Windows XP, Vista, & Windows 7 & 8. The unregistered version will calculate federal, GAAP, state, AMT, and ACE depreciation for multiple companies, with the unregistered version limitation that open years cannot be rolled forward. AcQuest Pro Depreciation uses Microsoft Jet database files to store asset information providing for easy manipulation with programs such as Microsoft Access. Supports most deprecation methods, including MACRS, 150% MACRS, MACRS straight line, ACRS, ordinary straight line, 200% 150% and 125% declining-balance, amortization, and units of production. Prints Form 4562. Context sensitive help.

Related software (5)

Cashbook Complete

Cashbook Complete is an accounting package that leads the way in the 'keep it simple' accounting market. It has user friendly screens and uses simple accounting terminology through ...

AcQuest HQ Depreciation

AcQuest HQ Depreciation. Windows XP, Vista, & Windows 7 & 8. Fed. and GAAP depreciation. With shareware version, open years cannot be rolled forward. Supports most deprecation meth ...

Basic Bookkeeping

Unlike double entry systems, Basic Bookkeeping's single entry method is intuitive. You simply enter your income and expenses. The program then generates a wide variety of reports f ...

Loan And Mortgage

Loan And Mortgage is a loan amortization schedule calculator that handles virtually any loan type. This program is user-friendly, flexible and loaded with useful features that show ...

AcQuest 941 Solution 2015

AcQuest 941 Solution 2015. Windows XP, Vista, & Windows 7 & 8. Prepares federal Form 941, Employer's Quarterly Federal Tax Return. With unregistered version, data can be printed bu ...