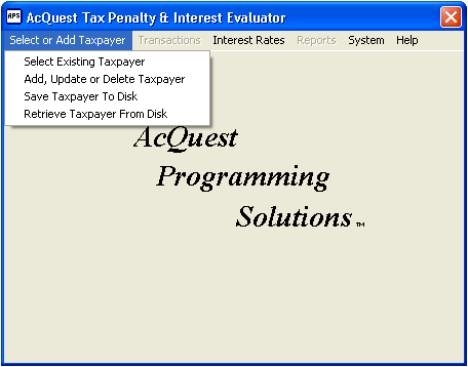

Acquest tax penalty interest evaluator

Download URL | Author URL | Software URL | Buy Now ($50)

AcQuest Programming Solutions is pleased to publish the Tax Penalty & Interest Evaluator.

Designed to run on Windows XP, Vista, and Windows 7 & 8, the AcQuest Tax Penalty & Interest Evaluator will calculate federal tax penalties and interest for multiple entities, with the demo version limitation of ten days of use or five uses.

· The AcQuest Tax Penalty & Interest Evaluator calculates the failure to pay, failure to file, negligence, and failure to deposit penalties.

· Supports individual, corporate, and employer entities.

· Uses Microsoft Jet database files to store taxpayer information, providing for easy manipulation with programs such as Microsoft Access.

· Online help manual with examples and relevant IRS publications.

In its unregistered form the program can be used for ten days or five uses.

A license key will be e-mailed to the purchaser which will deactivate the demo usage limitations and make re-installation unnecessary.

The price of one license key to fully e

Related software (5)

ARM Mortgage Calculator

This interactive mortgage calculator gives you a thorough estimation of your mortgage costs, including the annual percentage rate. It works with adjustable rate mortgages, as well ...

AcQuest 1120S Solution 2015

AcQuest 1120S Solution 2014. Windows XP, Vista, & Windows 7 & 8. Prepares Form 1120S, U.S. Corporation Income Tax Return for an S Corporation, K-1's, Sch D, 4562, 4797, 8825, & Dep ...

Loan And Mortgage

Loan And Mortgage is a loan amortization schedule calculator that handles virtually any loan type. This program is user-friendly, flexible and loaded with useful features that show ...

The Financial Partner

The Financial Partner, has been designed with the accounting and finance professional in mind. The software is composed of amortization, interest, value of money and discounted cas ...

Penalty Shootout

Beat your opponent and lead your country to victory!